Licence: Public Domain Mark

Credit: Diseases of Animals Act, 1894. Source: Wellcome Collection.

Provider: This material has been provided by The Royal College of Surgeons of England. The original may be consulted at The Royal College of Surgeons of England.

52/56 page 48

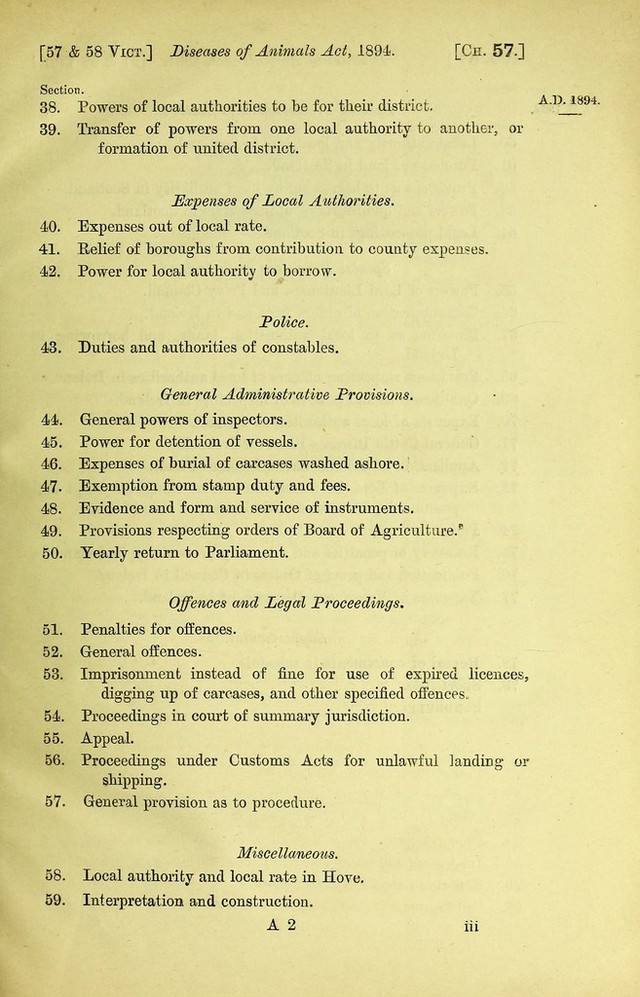

![53 & 54 Viet, c. 60. [Ch. 57.] Diseases of Animals Act, 1894. [57 & 58 Vict.] expenditure of the Cattle Pleuro-pneumonia Account for Great Britain and the Cattle Pleuro-pneumonia Account for Ireland shall be made up in such form and with such particulars as may be directed by the Treasury, and such accounts shall be audited by the Comptroller and Auditor-General as public accounts in accordance with such regulations as the Treasury may make, and shall be laid before Parliament, together with his report thereon. 3. If at the end of any financial year the Treasury, after communication with the Board of Agriculture, or the Lord Lieutenant and Privy Council, as the case may be, are satisfied that the balance standing to the credit of cither of the said Cattle Pleuro-pneumonia Accounts, or any part of such balance, will not be required for the purposes of this Act, they may— (a) in the case of the Cattle Pleuro-pneumonia Account for Great Britain direct such balance or part to be paid in the proportions provided by this Schedule into the Local Taxation Account and the Local Taxation (Scotland) Account, in repayment of any sums which have been paid to the Cattle Pleuro-pneumonia Account out of the said Local Taxation Accounts ; and (b) iii the case of the Cattle Pleuro-pneumonia Account for Ireland, direct such balance or part to be paid into the general account of the General Cattle Diseases Fund in repayment of any sums which have been paid out of the said general account for any of the purposes to which the Cattle Pleuro-pneumonia Account is by this Act applicable ; and in either case the Treasury may direct any balance or part which may not be required for such repayment to be paid into the Exchequer. 4. The proportions in which any sum is to be paid out of or into the Local Taxation Account and the Local Taxation (Scotland) Account under this Act shall be eighty-eight per centum of such sum out of or into the Local Taxation Account, and twelve per centum out of or into the Local Taxation (Scotland) Account. 5. All money paid under this Act out of or into the Local Taxation Account shall in account be charged against or credited to the proceeds of the probate duty. 6. All moneys paid under this Act out of or into the Local Taxation (Scotland) Account shall in account be charged against or credited to the residue of the Scotch share of the local taxation (customs and excise) duties in manner provided by section two of the Local Taxation (Customs and Excise) Act, 1890. 7. Payments out of or into the said Cattle Pleuro-pneumonia Accounts, and all other matters relating to the accounts and to the moneys standing to the credit of the accounts shall be made and regulated in such manner as the Treasury direct.](https://iiif.wellcomecollection.org/image/b2241695x_0054.jp2/full/800%2C/0/default.jpg)