The National Insurance (Industrial Injuries) Act, 1946 / with general introduction and annotations by N.P. Shannon and Douglas Potter.

- United Kingdom

- Date:

- 1946

Licence: Public Domain Mark

Credit: The National Insurance (Industrial Injuries) Act, 1946 / with general introduction and annotations by N.P. Shannon and Douglas Potter. Source: Wellcome Collection.

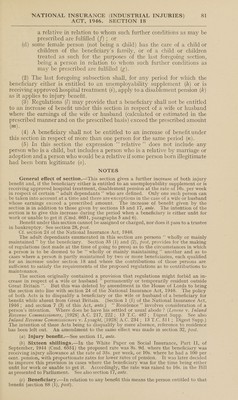

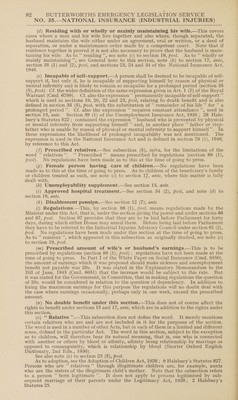

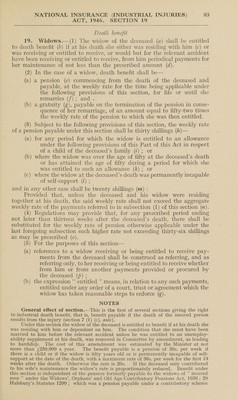

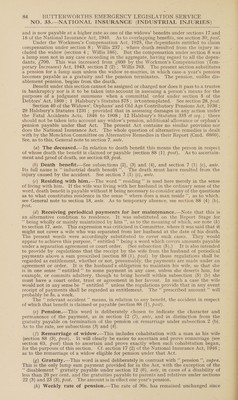

91/252 (page 81)

![AQT, 1946. SECTION 18 a relative in relation to whom such further conditions as may be prescribed are fulfilled (f) ; or (d) some female person (not being a child) has the care of a child or children of the beneficiary’s family, or of a child or children treated as such for the purposes of the last foregoing section, being a person in relation to whom such further conditions as may be prescribed are fulfilled (g). (2) The last foregoing subsection shall, for any period for which the beneficiary either is entitled to an unemployability supplement (/) or is receiving approved hospital treatment (7), apply to a disablement pension (A) as it applies to injury benefit. (3) Regulations (/) may provide that a beneficiary shall not be entitled to an increase of benefit under this section in respect of a wife or husband where the earnings of the wife or husband (calculated or estimated in the prescribed manner and on the prescribed basis) exceed the prescribed amount (m). (4) A beneficiary shall not be entitled to an increase of benefit under this section in respect of more than one person for the same period (n). (5) In this section the expression ‘‘ relative’ does not include-any person who is a child, but includes a person who is a relative by marriage or adoption and a person who would be a relative if some person born illegitimate had been born legitimate (0). NOTES General effect of section.—This section gives a further increase of both injury benefit and, if the beneficiary either is entitled to an unemployability supplement or is receiving approved hospital treatment, disablement pension at the rate of 16s. per week in respect of certain “ adult dependants ’’ who are defined. Only one such person can _ be taken into account at a time and there areexceptions in the case of a wife or husband whose earnings exceed a prescribed amount. The increase of benefit given by the section is in addition to those given by sections 15 and 17, ante. The intention of the section is to give this increase during the period when a beneficiary is either unfit for work or unable to get it (Cmd. 6651, paragraphs 5 and 6). Benefit under this section cannot be assigned or charged, nor does it pass to a trustee in bankruptcy. See section 28, post. Cf. section 24 of the National Insurance Act, 1946. The adult dependants enumerated in this section are persons “‘ wholly or mainly maintained ”’ by the beneficiary. Section 35 (1) and (2), post, provides for the making of regulations (not made at the time of going to press) as to the circumstances in which a person is to be deemed to be “ wholly or mainly maintaining ’’ another and as to cases where a person is partly maintained by two or more beneficiaries, each qualified for an increase under section 18 and where the contributions of those persons are sufficient to satisfy the requirements of the proposed regulations as to contributions to maintenance. The section originally contained a provision that regulations might forbid an in- crease in respect of a wife or husband “‘ permanently or temporarily resident outside Great Britain’’. But this was deleted by amendment in the House of Lords to bring , the section into line with section 24 of the National Insurance Act, 1946. The policy of both Acts is to disqualify a beneficiary or the wife or husband of a beneficiary for benefit while absent from Great Britain. (Section 1 (1) of the National Insurance Act, 1946; and section 7 (3) of this Act, ante.) ‘‘ Residence ’’ involves consideration of a person’s intention. Where does he have his settled or usual abode ? (Levene v. Inland Revenue Commissioners, [1928] A.C. 217, 222; 13 T.C. 487; Digest Supp. See also Inland Revenue Commissioners v. Lysaght, [1928] A.C. 234; 13 T.C. 511; Digest Supp.) The intention of these Acts being to disqualify by mere absence, reference to residence has been left out. An amendment to the same effect was made in section 32, post. (a) Injury benefit.—See section 11, ante. (6) Sixteen shillings.—In the White Paper on Social Insurance, Part II, of September, 1944 (Cmd. 6551) the proposed rate was 8s. 9d. where the beneficiary was receiving injury allowance at the rate of 35s. per week, or 10s. where he had a 100 per cent. pension, with proportionate rates for lower rates of pension. It was later decided to improve this provision in cases where the beneficiary was for the time being either unfit for work or unable to get it. Accordingly, the rate was raised to 16s. in the Bill as presented to Parliament. See also section 17, ante. ¢ (c) Beneficiary .—In relation to any benefit this means the person entitled to that benefit (section 88 (1), post).](https://iiif.wellcomecollection.org/image/b32173386_0091.jp2/full/800%2C/0/default.jpg)