BSE, the cost of a crisis : thirty-fourth report, together with the proceedings of the Committee relating to the report, the minutes of evidence and appendices / Committee of Public Accounts.

- Public Accounts Committee

- Date:

- 1999

Licence: Open Government Licence

Credit: BSE, the cost of a crisis : thirty-fourth report, together with the proceedings of the Committee relating to the report, the minutes of evidence and appendices / Committee of Public Accounts. Source: Wellcome Collection.

62/68 (page 36)

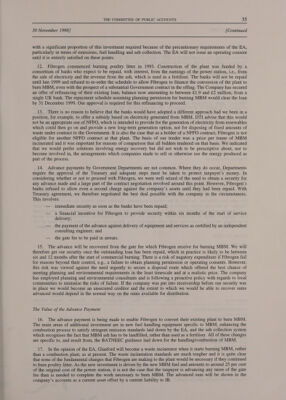

![30 November 1998] [Continued 18. Each of the eight companies we invited to submit costed proposals were treated exactly alike. None were specifically offered the opportunity for an advance payment, although two of the companies indicated that advance funding was a requirement of their tender. The tender from the other company seeking an advance, ScotPower, did not meet our evaluation criteria and was rejected. Whilst not explicitly seeking an advance, other companies bidding for the work have sought certain assurances from us, such as underwriting planning costs, but these have largely been negotiated away. 19. The position taken by their banks prevented Fibrogen from raising the necessary funds from the market to convert the plant. The company is not able to earn interest on the advance payment we are making. To put it simply the project would not have proceeded had we not been willing to advance a proportion of the gate fee to fund the conversion process. It is, however, legitimate to compare the overall deal with that being offered by Fibrogen’s main competitors with account being taken of the value of the advance payment being made to Fibrogen, as at Annex B. If we adjust the gate fee upwards to take account of the cost of advance payment the adjusted gate fee is still cheaper than the gate fee being offered by the other companies. Moreover a combination of an earlier start to the service and the higher volumes being burnt mean that additional savings accrue to the taxpayer in terms of reduced storage fees and the bringing forward of EU reimbursement to the Exchequer. 20. In my view, Annex B underlines the strength of the Fibrogen proposal over other tenders received, three of which are still under consideration. The contract was let on the basis of competitive tender and a clawback clause is inappropriate and not negotiable. Treasury Involvement 21. Treasury officials were kept fully informed of the emerging options, the costs and the risks. They participated in a number of early meetings and took opportunities during visits to our Reading offices to keep their information up to date. More formal approaches were made to the Treasury when it became clear in the course of negotiation that there would be a risk of nugatory expenditure if the contract was signed and the project subsequently failed. Given the exceptional circumstances surrounding MBM disposal (i.e., the need for urgent action, concern about lifting the beef export ban, and the long term storage of MBM) and the relatively low gate fees (offsetting the cost of the advance payments), Treasury were content for us to contract with Fibrogen on the terms stated, subject to the full details of the contract, particularly the nature of the advance (non-secured) and the attendant risk being put to Ministers and their signifying agreement. They also advised that Parliament should be informed about the deal. For reasons of commercial confidentiality, and to avoid jeopardizing ongoing negotiations with other suppliers, this information was provided in the form of the Memorandum submitted to the Committee on 30 October on which it took further evidence on 30 November. George Trevelyan Chief Executive Intervention Board December 1998 ANNEX A Fibrogen Companions Scottish | Glen Glanford Fibropower' Rest William Requirement Power Farm Plant Eye plant PDM (Cassidy) Forrest Rechem Quality and Volume of Service — — — — — = — at (20 per cent) How soon services can be delivered — — — — == sec. a — (25 per cent) Track Record (10 per cent) -= — — — —_ ae os = Flexibility (15 per cent) oo — = = — = ae —_ Suitability of premises, plant, etc., — a — = = Bes a= fi to OTMS/SCS (5 per cent) Price (25 per cent) — —— = = — = — — Overall Score 37 48 78 63 68 74 53 68 ' Proposal from sister plant to Fibrogen. Shares same technology and basis of proposal same as for Fibrogen, i.e., advance funding of gate fee to cover conversion of plant to burn MBM. Project Board awarded provisional markings for Quality and Volume of Service and Flexibility on basis that benefit of Fibrogen had to be demonstrated before further investment in equivalent technology could be justified.](https://iiif.wellcomecollection.org/image/b32227048_0062.jp2/full/800%2C/0/default.jpg)