The Private Finance Initiative : sixth report, together with the proceedings of the Committee, minutes of evidence and appendices / Treasury Committee.

- Great Britain. Parliament. House of Commons. Treasury Committee

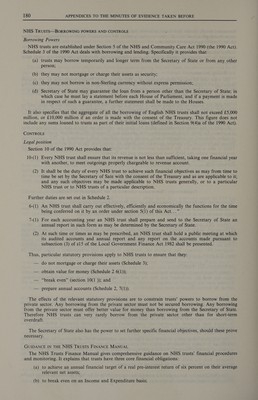

- Date:

- 1996

Licence: Open Government Licence

Credit: The Private Finance Initiative : sixth report, together with the proceedings of the Committee, minutes of evidence and appendices / Treasury Committee. Source: Wellcome Collection.

212/228 (page 176)

![2. The cost of capital to central Government used in appraising expenditure decisions is currently set at 6 per cent in real terms (Annex G of Economic Appraisal in Central Governments—A Technical Guide to Government Departments). The 6 per cent rate is based on the pre-tax long-term rate of capital for low risk purposes in the private sector. This allows for an efficient comparison at the margin between the costs of in-house provision and private sector service provision. 3. The same rate of 6 per cent real is also used as a discount rate in the public sector, although there are some exceptions to it (see below). Discount rates are used in investment appraisals to compare costs and benefits over time to reflect the taxpayers’ preferences for enjoying benefits earlier and costs later. DISCOUNT RATES FOR APPRAISING PFI SCHEMES 4. For PFI projects where services are sold to the public sector and for joint ventures, DOT appraise projects in accordance with the guidance given in annexes E and G of the Treasury Green Book. 5. For the majority of public sector projects, the 6 per cent real rate is applied. It is normally used when the public sector is the purchaser of goods or services supplied by the private sector. In some cases, central government output is sold in commercial markets. Such bodies selling output often have to make a required rate of return (RRR) of 8 per cent. This is the return required to be earned by the industry on the assets which it owns so as to provide a level playing field with private sector companies. It is based on the expected real return on assets in industrial and commercial (ICC) companies (excluding the North Sea), but is set lower than the expected ICC return over the long-term to reflect amongst other factors, the relatively low risk of many public sector activities. The 8 percent is greater than the 6 per cent because it is an average, as opposed to a marginal return on an individual project. 6. To be consistent with their RRR, projects for these bodies have been appraised using a discount rate of 8 per cent. This has been the case in the past for railways investments. As the Department of Transport moves from being a supplier of services to a purchaser of services, the occasions on which a 6 per cent discount rate is used have increased. 7. To ensure consistency between rail and road appraisals, the same discount rate of 8 per cent is used to appraise both publicly financed roads and Design Build Finance Operate (DBFO) contracts. DISCOUNT RATES AND RISK 8. Central government discount rates are not adjusted to take account of variability risk, in the sense of the possibility of more than one outcome occurring. Adjusting the discount rate for different degrees of risk could distort the choice of project. Annex C of the Green Book sets out guidance on dealing with risk in publicly financed projects. 9. Note this is separate from the issue of optimistic bias, where the expected value of public sector costs is estimated as unduly optimistic. The Department would argue strongly that full account is taken of risks in estimating the values of the costs and benefits in roads appraisals that it carries out. Public inquiries of individual road schemes need to be convinced that schemes are economically justified and appraisals are scrutinised closely to ensure that this is the case. PRIVATE AND PUBLIC SECTOR COSTS OF CAPITAL 10. The cost of capital to private sector participants in PFI projects may be different from that used by the public sector when appraising the project. The private sector cost of capital will be reflected in the private sector bid and, hence, in the Government’s assessment of its value for money. COST OVERRUNS ON ROAD SCHEMES 11. The Committee asked for further information on the difference between bid and outturn prices for conventional procurement of roads construction (Questions 353-355 refer). 12. The National Audit Office (NAO) reported on contracting for roads in November 1992. Part 3 of their report, on controlling the cost of contracts, is attached for reference.[Not printed] They sampled 120 contracts each worth more than £1 million and estimated a cost increase of some 27 per cent over tender prices, the main reasons being attributed to unforeseen ground conditions and changes or other problems with design following contract signature. The 40 per cent or so mentioned in the hearing refers in fact to proportions of the value of the identified cost increase accounted for by ground conditions or changed Departmental requirements. At that time, virtually all of the Department’s contracts for road building were on a re-measure basis, which permitted detailed design change post-signature and attributed the risk of unforeseen ground conditions to the client rather than contractor. An extract from the Treasury minute, published on 19 October 1993, is attached.[Nor printed] This recorded the measures taken and intended by the Department in response to conclusions of the Public Accounts Committee on the NAO report. It foreshadows the intention, since carried into effect, to introduce a Design and Build form of contract for much of the Departmental’s road construction work. The current work on Design Build](https://iiif.wellcomecollection.org/image/b32218151_0212.jp2/full/800%2C/0/default.jpg)